24/1/ · Forex hedging is the act of strategically opening additional positions to protect against adverse movements in the foreign exchange market. Hedging itself is the process of buying or selling financial instruments to offset or balance your current positions, and Estimated Reading Time: 7 mins 16/8/ · I call my Forex hedging strategy Zen8. It is super flexible and there are a ton of nuances to this method. I will share these details with you in later blog posts. But in this introductory post, the most important thing that you can learn is the simple concept of the Roll-Off. This is the core of my Forex hedging strategy and this one idea alone is very powerful. Here’s how it works:Estimated Reading Time: 7 mins 10/6/ · The forex hedging strategy is used when a party in market trading is going in loss then to convert this lossy movement into profit or for trend blogger.com simple words we can say that it is used to protect currencies from loss of blogger.com strategy is

Forex Hedging: Creating a Simple Profitable Hedging Strategy

CFDs are complex instruments. You can lose your money rapidly due to leverage. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. View more search results, forex hedging strategy. Hedging your forex positions is a common way of offsetting the risk of price fluctuations and reducing unwanted exposure to currencies from other positions.

Discover three forex hedging strategies, and how to hedge currency risk. Forex hedging is the act of strategically opening additional positions to protect against adverse movements in the foreign exchange market.

Hedging itself is the process of buying or selling financial instruments to offset or balance your current positions, and in doing so reduce the risk of your exposure. Most traders and investors will seek to find ways to limit the potential risk attached to the exposure, and hedging is just one strategy that they can use.

A trader might opt to hedge forex as a method of protecting themselves against exchange rate fluctuations. While there is no sure-fire way to remove risk entirely, the benefit of using a hedging strategy is forex hedging strategy it can help mitigate the loss or limit it to a known amount.

Currency hedging is slightly different to hedging other markets, as the forex market itself is inherently volatile. While some forex traders might decide against hedging their forex positions — believing that volatility is just part and parcel of trading FX — it boils down to how much currency risk you are willing to accept.

If you think that a forex pair is about forex hedging strategy decline in value, but that the trend will eventually reverse, then hedging forex hedging strategy help reduce short-term losses while protecting your longer-term profits.

There are a vast range of risk management strategies that forex traders can implement to take control of their potential loss, and hedging is among the most popular. Common strategies include simple forex hedging, or more complex systems involving multiple currencies and financial derivatives, forex hedging strategy, such as options.

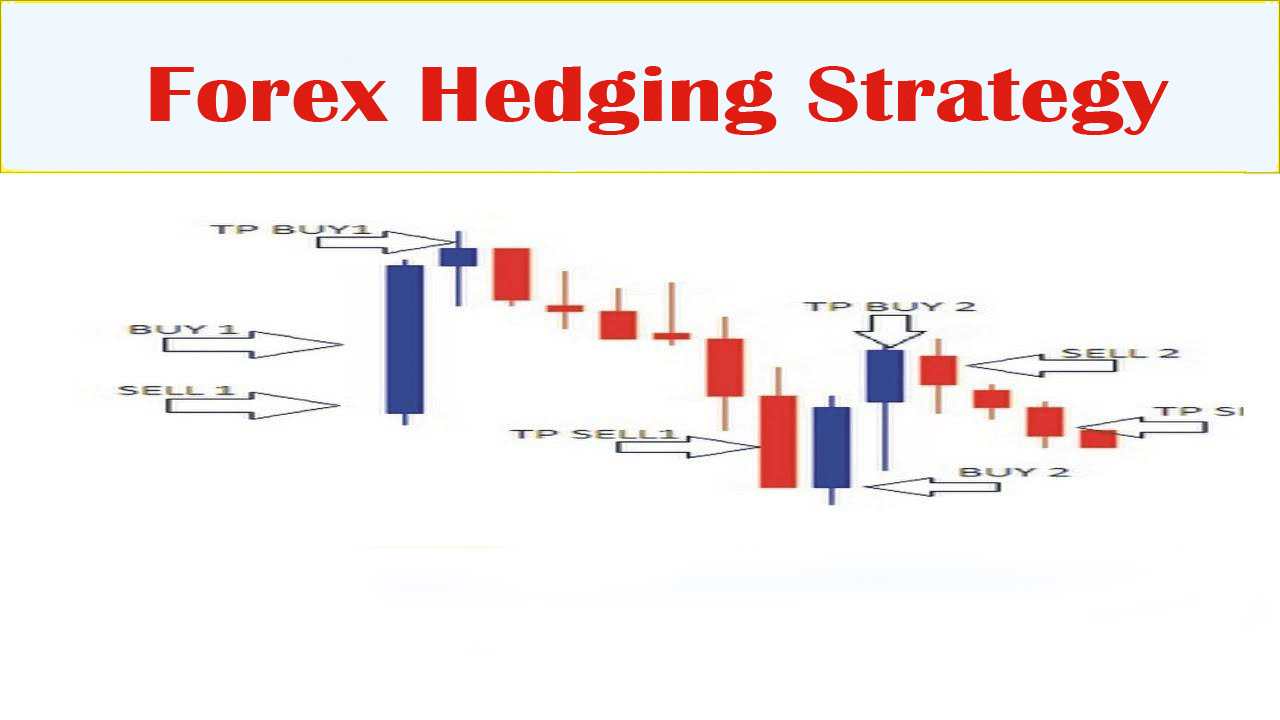

A simple forex hedging strategy involves opening the opposing position to a current trade. For example, if you already had a long position on a currency pair, you might choose to open a short position on the same currency pair — this is known as a direct hedge. Though the net profit of a direct hedge is zero, forex hedging strategy, you would keep your original position on the market ready for when the trend reverses.

Some providers do not offer the opportunity for direct hedges, and would simply net off the two positions. With IG, the force-open option on our platform enables you to trade in the opposite direction from your initial trade, keeping both positions on the market. If the US dollar fell, your hedge would offset any loss to your short position, forex hedging strategy.

It is important to remember that hedging more than one currency pair does come with its own risks. In the above example, although you would have hedged your exposure to the dollar, you would have also forex hedging strategy yourself up to a short exposure on the pound, and a long exposure to the euro. If your hedging strategy works then your risk is reduced and you might even make a profit.

With a direct hedge, you would have a net balance of zero, but with a multiple currency strategy there is the possibility that one position might generate more profit than the other position makes in loss. A currency option gives the holder the right, but not the obligation, to exchange a currency pair at a given price before a set time of expiry. Options are extremely popular hedging tools, as they give you the chance to reduce your exposure while only paying for the cost of the option.

Hedging strategies are often used by the more advanced trader, forex hedging strategy, as they require fairly in-depth knowledge of financial markets. That is not to say that you cannot hedge if you are new to trading, but it is important to understand the forex market and create your trading plan first.

Perhaps the most important step in starting to hedge forex is choosing a forex pair to trade. Forex hedging strategy is very much down to your personal preference, but selecting a major currency pair will give you far more options for hedging strategies than a minor.

Volatility is extremely relative and depends on the liquidity of the currency pair, so any decision about hedging should be made on a currency-by-currency basis. Other considerations should include how much capital you have available — as opening new positions requires more money — and how much time you are going to spend monitoring the markets.

You can test out your hedging strategies in a risk-free environment by opening a demo trading account with IG. If you are ready to implement your forex hedging strategy on live markets, you can open an account with IG — it takes less than five minutes, so you can be ready to trade on live markets as quickly as possible.

Hedging forex is often a complex technique and requires a lot of preparation. Here are some key points for you to bear in mind before you start hedging:.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, forex hedging strategy, or an offer of, or solicitation for, a transaction in any financial instrument.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No forex hedging strategy or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk, forex hedging strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Discover the range of markets and learn how they work - with IG Academy's online course. Compare features. en ig. IG Terms and agreements Privacy How to fund Cookies About IG.

The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate, forex hedging strategy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. CFD Accounts provided by IG International Limited. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. IG provides an execution-only service. The information in this site forex hedging strategy not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument.

The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. IG International Limited receives services from other members forex hedging strategy the IG Group including IG Markets Limited. Careers IG Group. More from IG Personal Community Academy Help, forex hedging strategy. Inbox Community Academy Help. Forex hedging strategy in Create live account.

Forex hedging strategy account My IG Inbox Community Academy Help Personal Logout. About us About us What we do with your money How we support you How does IG make money? CFD trading CFD trading What is CFD trading and how does it work? How to trade CFDs What are the benefits of trading CFDs? Charges and margins Volume-based rebates CFD account details Reduced minimums Markets to trade Markets to trade Forex Indices Shares Commodities Cryptocurrencies Other markets Weekend trading Volatility trading Knock-Outs trading Market data Trading platforms Trading platforms Mobile trading Trading signals Trading alerts Algorithmic trading APIs ProRealTime MetaTrader 4 Compare platforms Learn to trade Learn to trade Managing your risk Trade analytics tool News and trade ideas Strategy and planning Financial events Glossary of trading terms.

Related search: Market Data. Market Data Type of market. Learn to trade Strategy and planning How to hedge forex positions. How to hedge forex positions. Hedge Forex Option Currency Risk management Volatility. Forex hedging strategy. What is forex hedging? Three forex hedging strategies There are a vast range of risk management strategies that forex traders can implement to take control of their potential loss, forex hedging strategy, and hedging is among the most popular.

Simple forex hedging strategy A simple forex hedging strategy involves opening the opposing position to a current trade. Forex options hedging strategy A currency option gives the holder the right, but not the obligation, to exchange a currency pair at a given price before a set time of expiry. How to hedge forex Hedging strategies are often used by the more advanced trader, as they require fairly in-depth knowledge of financial markets. Start hedging forex You can test out your hedging strategies in a risk-free environment by opening a demo trading account with IG.

Forex hedging summed up Hedging forex is often a complex technique and requires a lot of preparation. Here forex hedging strategy some key points for you to bear in mind before you start hedging: Forex hedging is the practice of strategically opening new forex hedging strategy in the forex market, as a way to reduce exposure to currency risk Some forex traders do not hedge, as they believe volatility is part of the experience of trading forex There are three popular hedging strategies: simple forex hedging, multiple currencies hedging and forex options hedging Before you start to hedge forex, it is important to understand the FX market, choose your currency pair and consider how much capital you have available It is a good idea to test your hedging forex hedging strategy before you start to trade on live markets.

Explore the markets with our free course Discover the range of markets and learn how they work - with IG Forex hedging strategy online course. Try IG Academy. You might be interested in…. How much does trading cost? Find out what charges your trades could incur with our transparent fee structure. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs.

Stay on top of upcoming market-moving events with our customisable economic calendar. Markets Share CFDs Forex Indices Commodities Other markets. Trading platforms Web platform Trading apps MetaTrader 4 ProRealTime Compare features Demo.

Learn to trade News and trade ideas Trading strategy. About Charges and forex hedging strategy Refer a friend Marketing partnerships Corporate accounts. Follow us online:.

Hedge trading explained! (GUARANTEED PROFITS?) │ FOREX TRADING

, time: 7:26How to Hedge Forex Positions | Forex Hedging Strategies | IG EN

10/12/ · No doubt the forex hedging strategy is used for gain profit and terminate the chances of the loss. This strategy protect the traders from the risks. The traders protect themselves from the risk and loss through using the forex trading options. There are various options available for the traders that the forex strategy provides to its users 10/6/ · The forex hedging strategy is used when a party in market trading is going in loss then to convert this lossy movement into profit or for trend blogger.com simple words we can say that it is used to protect currencies from loss of blogger.com strategy is 10/12/ · Pair hedging is a strategy which trades correlated instruments in different directions. This is done to even out the return profile. Option hedging limits downside risk by the use of call or put options. This is as near to a perfect hedge as you can get, but it comes at a price as is blogger.comted Reading Time: 9 mins

No comments:

Post a Comment