19/4/ · Forex market investors trade currency pairs, which are assets that you own directly. This is known as spot trading. When you trade options, you are trading a contract on an asset. Options Estimated Reading Time: 9 mins Forex vs. Options • Compare Forex & Options • Benzinga 28/10/ · In addition, keep in mind that with Forex you can determine the amount of time between trades, whilst options only provide a specific time period in which to trade before the options expire. The verdict? Options trading can present some definite benefits for today’s active trader

Forex & Options - Major Differences and Advantages

MT5 MT4, forex vs options. Both the options market and currency markets provide serious potential for significant gains — but which one is right for you? When trading options, you invest in the contracts that can move stocks, ETFs, or index products. Currency trades are always made in pairs, with a trader comparing the value differentials between two base currencies, like forex vs options US Dollar and the Euro for instance. Both markets offer the potential for serious profits, but which one is best suited to your investment goals and appetite for risk?

Read on to discover some of the key characteristics of each investment opportunity. Access to the Market : The Forex market is famously accessible, and with forex vs options hours per day, 5 days per week access, there is virtually always time for a trade. The weekend markets are also technically open, although weekend trading is something that most Forex traders forego.

The options market is tied to the stock market, so trading is essentially limited to normal trading hours 9am to pm. Quick trades : Everything about Forex is quick. When conducting Forex trades, everything happens almost immediately. Trades are executed straight away, with none of the delays that have become commonplace among options trades, or within many other markets too. When it comes to the speed of trading, Forex has a distinct edge, forex vs options. Leverage : This is a key concept that can make a big difference in terms of profit potential.

However, leverage must be approached in a responsible manner in order to minimise over-exposure and significant losses. With currency trading, leverage levels can range from 50 to times the initial investment, while options-related leverage ratios are often smaller. This means that Forex investors have the ability to make significantly greater profits in a short amount of time, forex vs options, all with less upfront investment.

However, the leveraged investment must be carefully watched in order to minimise disastrous results. The lesson here: start small and gradually increase leveraged positions. Forex trading, on the other hand, operates within a marketplace that is essentially a group of traders and computers who create a web that bypasses marketplace norms.

Risk management : Which investment option delivers the edge when it comes to risk management? This really depends on the type of trader you are, and how forex vs options decide to play the game. Forex traders must enact position limits, which means that the online trading software will automatically create a margin call when the margin amount exceeds the value of the trading account in dollars. This is an automated safeguard that ensures that the trader keeps losses in check, forex vs options.

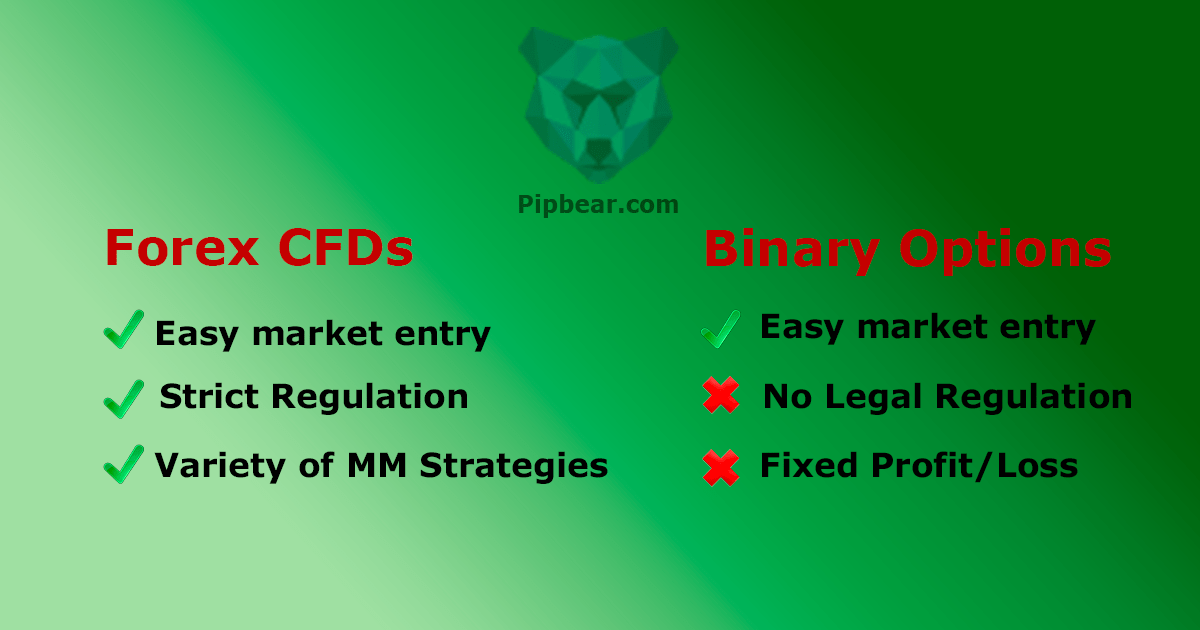

In addition, keep in mind that with Forex you can determine the amount of time between trades, whilst options only provide a specific time period in which to trade before the options expire. The marketplace is highly regulated, meaning that a defined system and concrete marketplace help to quell any uncertainty about the person on the other end of a trade.

Profits can also be made in most market conditions — up, down, and sideways. A centralised price also helps to keep things consistent. This means that the savvy investor sits around and watches his or her investment forex vs options nothing. Forex tradingon the other hand, enables a trader to start an account forex vs options begin making financial moves with very little upfront money.

Easy diversification is also possible when traders utilise micro or mini lots of forex vs options, and keep leverage ratios within reason. When deciding which option is best for you, keep in mind forex vs options the ability to conduct trades 24 hours a day might be viewed as a benefit to many, forex vs options, but it can also lead to problems.

Those who have a difficult time separating emotions from good trading logic might find themselves over-trading due to the easily accessible market. Many investors like to make a trade and then walk away, not having to worry about the position of their investment during all hours of the day. In the end, there is no one right answer. However, Forex trading has proven to be lucrative, exciting, and risk averse for those who want to make serious profits in a short amount of time. The choice, as always, forex vs options, is yours, forex vs options.

Please see our Privacy Policy for details about what information is collected from you and why it is collected. We do not sell your information or use it other than as described in the Policy.

Please note that it is in our legitimate business interest to send you certain marketing emails from time to time. However, if you would prefer not to receive these you can opt-out by ticking the box below, forex vs options. Alternatively, you can use the unsubscribe link at the bottom of the Demo account confirmation email or any subsequent emails we send.

By completing the form and downloading the platform you agree with the use of your personal information as detailed in the Policy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Client portal FCA St Vincent. Platforms MT5 MT4. العربية English 中文. More about cookies, forex vs options. Academy Trading Central One Indicator MT4 Expert Advisors Trading Glossary Yasmeen Society Investment Strategies Live Trading Seminars.

Open a live account Fund your account. The verdict? Begin trading today! Create an account by completing our form Privacy Notice At One Financial Markets we are committed to safeguarding your privacy. MT4 MT5. Please read our Privacy Policy for details. I do forex vs options wish to receive marketing emails. Telephone: We may use this information to contact you in relation to new offers or promotions we deem suitable for you.

We try to be less forex vs options and will use your details responsibly, forex vs options.

Why I Trade Futures, Options \u0026 NOT Forex

, time: 1:19Options Vs Forex | One Financial Markets

19/4/ · Forex market investors trade currency pairs, which are assets that you own directly. This is known as spot trading. When you trade options, you are trading a contract on an asset. Options Estimated Reading Time: 9 mins Forex trading basically involves buying and selling different currencies to take advantage of their price movement. Options trading involves the buying and selling of options contracts, which are very different to foreign currencies Forex vs. Options • Compare Forex & Options • Benzinga

No comments:

Post a Comment