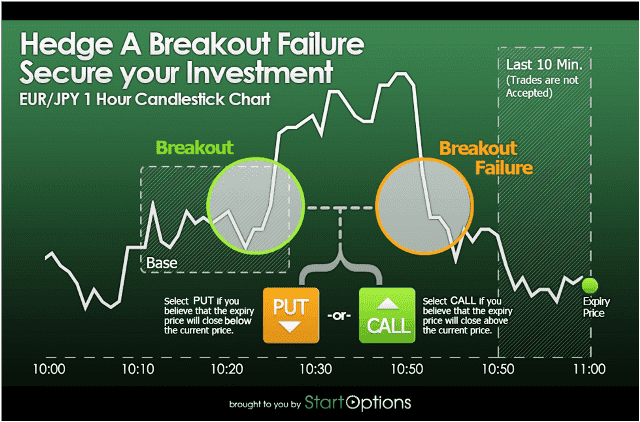

Trading binary options can help you hedge your losses, and improve your overall performance on the spot Forex market. What is Hedging? When you hedge, it means that you trade against your initial inclination. If you enter a short Forex trading position on EUR/USD, your hedge trade would be something that reflected a gain for the euro over the US dollar. Using binary options can be a smart way to hedge against your positions, 13 rows · Mar 19, · A binary put option can be used to meet the hedging requirements of the above-mentioned long Jul 09, · Let’s review an example of implementing your traditional Forex hedge using Binary Options: Say you take a conventional Forex EUR/JPY (short or long) position combined with a Stop-Loss. To hedge, you would simultaneously buy either a PUT or CALL Binary Option, in the opposite direction of your traditional Forex position. What this did is cover your losses or help you even be profitable in the event that your (short or long) position Estimated Reading Time: 2 mins

How To Hedge Stock Positions Using Binary Options

Binary option trading traditionally had been only available on lesser-known exchanges in the U. like Nadex and Cantorand with overseas brokerage firms. However, recently, the New York Stock Exchange NYSE introduced binary options trading on its platform, which will help binary options become more popular. Owing to their fixed amount all-or-nothing payout, binary options also called digital options are already very popular among traders.

Compared to the tradition plain vanilla put-call options that have a variable payout, binary options have fixed amount payouts, which help traders be aware of the possible risk-return profile upfront. The fixed amount payout structure with upfront information about maximum possible loss and maximum possible profit enables the binary options to be efficiently used for hedging.

This article discusses how binary options can be used to hedge a long stock position and a short stock position. To purchase a binary option, an option buyer pays the option seller an amount called the option premium. Binary options have other standard parameters similar to a standard option: a strike pricean expiry dateand an underlying stock or index on which the binary option is defined.

For exchange-traded binary options defined on stocks, the condition is linked to the settlement value of the underlying crossing over the strike price on the expiry date. If the condition is not met, the option seller pays nothing and keeps the option premium as his profit. In either case, the seller benefits if the condition is not met, as he gets to keep the option premium as his profit.

With binary options available on common stocks trading on exchanges like the NYSE, stock positions can be efficiently hedged to mitigate loss-making scenarios. Assume stock ABC, Inc. In essence, she is looking for assurance that:. Her long position in stock will incur losses when the stock price declines. Marrying the two can provide the required hedge. A binary put option can be used to meet the hedging requirements of hedging forex positions with binary options above-mentioned long stock position.

Here is a step-by-step calculation:. Here is the scenario analysis according to the different price levels of the underlying, at the time of expiry:. Consideration for real-life trading scenarios:, hedging forex positions with binary options.

Ideally, this loss should have been zero, hedging forex positions with binary options, as was observed in the example of binary put hedge example in the first section. The calculated value was Plain vanilla call and put options, and futures have traditionally been used as hedging tools. The introduction of binary options on heavily-traded stocks on large exchanges like NYSE will make hedging easier for individuals, giving them more instruments. The examples above, one for hedging long and one for short stock positions, indicate the effectiveness of using binary options for hedging.

With so many varied instruments to hedge, traders and investors, should select the one that suits their needs best at the lowest cost. Your Money. Personal Finance, hedging forex positions with binary options. Your Practice. Popular Courses. Table of Contents Expand. Quick Primer To Binary Options. Hedge Longs Using Binary Options.

Hedge Shorts Using Binary Options. The Bottom Line. Key Takeaways Binary options are a type of exotic options contract that has a fixed payout if the underlying asset moves past the predetermined threshold or strike price. Unlike traditional options contracts, binary options do not exercise or convert to the underlying shares or asset.

Binary options can be used to hedge either long or short positions. Take the Next Step to Invest. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Articles. Partner Links.

Related Terms Exotic Option Definition Exotic options are options contracts that differ from traditional options in their payment structures, expiration dates, and strike prices. Binary Option A binary option is an option that either pays hedging forex positions with binary options fixed monetary amount or nothing at all, depending on whether it expires in the money.

Outright Option Definition and Example An outright option is an option that is bought or sold individually, and is hedging forex positions with binary options part of a multi-leg options trade. Double No-Touch Option Definition A double no-touch option gives the holder a specified payout if the price of the underlying asset remains in a specified range until expiration. Reverse Conversion Definition A reverse conversion is a form of arbitrage that enables options traders to profit from an overpriced put option no matter what the underlying does.

Forward Start Option Definition A forward start option is an exotic option that is bought and paid for now but becomes active later with a strike price determined at that time. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Hedging forex positions with binary options publishing family.

hedging on binary option from $10-$99,IQOption

, time: 11:24Hedging Forex Trades with Currency Binaries | Binary Trading

13 rows · Mar 19, · A binary put option can be used to meet the hedging requirements of the above-mentioned long If you have a binary options account as well as a Forex account, another thing you can do is use the binary option as a hedge against your Forex bet Jul 09, · Let’s review an example of implementing your traditional Forex hedge using Binary Options: Say you take a conventional Forex EUR/JPY (short or long) position combined with a Stop-Loss. To hedge, you would simultaneously buy either a PUT or CALL Binary Option, in the opposite direction of your traditional Forex position. What this did is cover your losses or help you even be profitable in the event that your (short or long) position Estimated Reading Time: 2 mins

No comments:

Post a Comment