Leverage = 1/Margin = /Margin Percentage Example: If the margin is , then the margin percentage is 2%, and leverage = 1/ = / 2 = To calculate the amount of margin used, multiply the size of the trade by the margin percentage Jun 15, · In forex trading, high leverage means you have to put in a small amount of capital to open a position. This capital is referred to as margin requirements. Among the high leverage brokers in Australia, Pepperstone offers the most competitive leverage trading conditions: Raw spreads with no markups (average EUR/USD spread of pips)Estimated Reading Time: 8 mins Jun 25, · Depending on how much leverage your trading account offers, you can calculate the margin required to hold a position. For example, if you have a

How Leverage Works in the Forex Market

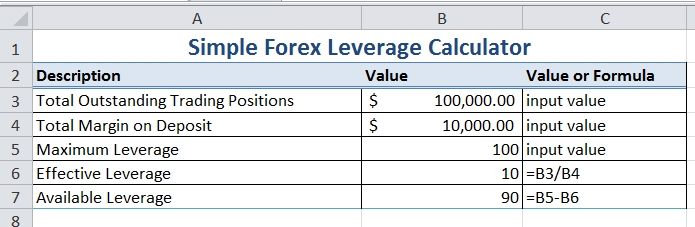

Use the leverage calculator to quickly find our how much leverage do you need to open a position. Leverage is investing money with borrowed funds. Leverage increases the potential of trading profits, however with increased leverage comes increased risk and therefore you can lose more. Forex computation with leverage is the ratio between the notional value of a trade and the currency used to open the trade, usually the domestic currency of the account.

For example, forex computation with leverage, a European trader will have a base currency of EUR while a US trader will have the base currency of USD. The amount of leverage you use in your trading account determines the margin level you must maintain otherwise you can get a margin call. A leverage ratio calculation is complex however with our forex forex computation with leverage calculator you just need to input a few values and calculate it easily:.

Once calculated, you will see the exact leverage required to open the trade. Keep in mind that the leverage shown is the minimal forex computation with leverage - a lower leverage will not allow to open the trade while a higher leverage can be used as long as your broker allows it. The operating leverage is the effective leverage used in your account to hold the open positions.

In other words, it is the ratio between total net open positions to total margin on your deposit. Effective or operating leverage cannot exceed the max leverage of forex computation with leverage trading account, forex computation with leverage. For example: if you have an open EURUSD trade for 0. This means that every 10 EUR in value of the trading position is controlled by 5 EUR of your account balance. That would depend on your risk tolerance.

Usually a high leverage is used with small accounts or for short term trading methods such as scalping as price fluctuation is limited while long term trading systems such as trend-following since price can fluctuate greatly or large accounts use a lower leverage. That would depend on several factors: How much of your deposit are you willing to lose? Do you have a working and successful trading system? Are you trading full time or just as a hobby? Moreover, have you fully and thoroughly tested and backtested your trading system forex computation with leverage a demo and on a live account before going all in?

Finally, what is the purpose of your trading account? Absolutely not. A losing trading system will lose faster with a higher leverage so you should use an appropriate leverage for the correct scenario.

Position Size Calculator. Pip Calculator. Margin Calculator. Fibonacci Calculator. Pivot Point Calculator. Risk of Ruin Calculator. Compounding Calculator. Drawdown Calculator, forex computation with leverage. Profit Calculator. Rebate Calculator. Continue to Myfxbook. Sign In Sign Up.

Home Home Economic Calendar Forex Calculators Forex Calculators. Popular: Economic Calendar Calculators News spreads Sentiment Heat Map Correlation. CONTACTS To use chat, please login. Back to contacts New Message. New messages. Home Forex Calculators Leverage Calculator.

Would you like to receive premium offers available to Myfxbook clients only to your email? You can unsubscribe from these emails at any time through the unsubscribe link in the forex computation with leverage or in your settings area, 'Messages' tab. Leverage Calculator. Currency Pair: AUDCAD AUDCHF AUDJPY AUDNZD AUDSGD AUDUSD CADCHF CADJPY CHFJPY CHFSGD EURAUD EURCAD EURCHF EURCZK EURGBP EURHUF EURJPY EURMXN EURNOK EURNZD EURPLN EURSEK EURSGD EURTRY EURUSD EURZAR GBPAUD GBPCAD GBPCHF GBPJPY GBPMXN GBPNOK GBPNZD GBPSEK GBPSGD GBPTRY GBPUSD NOKJPY NOKSEK NZDCAD NZDCHF NZDJPY NZDUSD SEKJPY SGDJPY USDCAD USDCHF USDCNH USDCZK USDHUF USDJPY USDMXN USDNOK USDPLN USDRUB USDSEK USDSGD USDTHB USDTRY USDZAR XAGAUD XAGEUR XAGUSD XAUAUD XAUCHF XAUEUR XAUGBP XAUJPY XAUUSD XBRUSD XPDUSD XPTUSD XTIUSD ZARJPY.

Account Currency: AUD CAD CHF EUR GBP JPY NZD USD. Trade size Lots :. EURUSD: 1. Use the leverage calculator to quickly find our how much leverage do you need to open a position What is Forex Leverage?

How to calculate leverage ratio? How to calculate operating leverage? How much leverage should I use? What leverage should I use? Is higher leverage better? Forex Calculators. Position Size Calculator Pip Calculator Margin Calculator Fibonacci Calculator Pivot Point Calculator Risk of Ruin Calculator Compounding Calculator Drawdown Calculator Profit Calculator Rebate Calculator.

Share Share this page! Terms Privacy Site Map Marketing Terms, forex computation with leverage. All Rights Reserved. HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance.

You could lose some or all of your initial investment. Do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions. Any data and information is provided 'as is' solely for informational purposes, and is not intended for trading purposes or advice.

Past performance is not indicative of future results. All Quotes x. EURUSD 1, forex computation with leverage. Dear User, We noticed that you're using an ad blocker. Myfxbook is a free website and is supported by ads. In order to allow us to keep developing Myfxbook, please whitelist the site in your ad blocker settings. Thank you for your understanding! You're not logged in. This feature is available for registered members only.

Registration is free and takes less than a minute. Click the sign up button to continue. Unless you're already a member and enjoying our service, then just sign in, forex computation with leverage.

Lesson 10: All about margin and leverage in forex trading

, time: 23:38How to Calculate Leverage, Margin, and Pip Values in Forex, with Examples

Jun 26, · What is Forex Leverage? Leverage is a common financial term which, in simple terms is the ration of company debt to company investment/shares. Leverage is sometimes referred to as Gearing. In business terms, leverage can be described as The ability to influence a system/environment to multiply the output without increasing the blogger.comted Reading Time: 2 mins Leverage = 1/Margin = /Margin Percentage Example: If the margin is , then the margin percentage is 2%, and leverage = 1/ = / 2 = To calculate the amount of margin used, multiply the size of the trade by the margin percentage Margin Pip Calculator Use our pip and margin calculator to aid with your decision-making while trading forex. Maximum leverage and available trade size varies by product. If you see a tool tip next to the leverage data, it is showing the max leverage for that product

No comments:

Post a Comment