Like any financial market the Forex market has a bid ask spread. This is simply the difference between the price at which a currency pair can be bought and sold. This is what accounts for the negative number in the “profit” column as soon as you place a trade. Before we go any further let’s define the two terms, “bid price” and “ask price”.Estimated Reading Time: 4 mins It appears to the right of the Forex quote. For example, in the same EUR/USD pair of /47, the ask price us This means you can buy one EUR for USD. The Forex bid & ask spread represents the difference between the purchase and the sale rates. This signifies the expected profit of the online Forex Trading transaction. The value of Bid/Ask Spread is set by the liquidity of a stock. If 9/26/ · To read and understand a forex quote, it helps to become familiar with the terminology. It all starts with a currency pair, which tells you the currencies involved in the trade. In a quote, the currency pair is often followed by a bid and ask price, which will reveal the spread and the number of pips between the broker's bid and ask blogger.comted Reading Time: 3 mins

What Is the Bid and Ask in Forex? [ Update]

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. See our updated Privacy Policy here. Note: Low and High figures are for the trading day. This article covers the most important aspects of a forex quote that all traders must know — including top tips on how to read a currency pair:.

Forex quotes reflect the price of different currencies at any point in time. A forex quote is the price of one currency in terms of another currency. These quotes always involve currency pairs because you are buying one currency by selling another. Brokers will typically quote two prices for any currency pair and receive the difference spread between the two prices, under normal market conditions.

The following sections will expand on the different aspects of a forex quote. The same quote will be used throughout this piece to keep the numbers consistent. This example is presented below:. In order to read currency pairs correctly, traders should be aware of the following fundamentals of a forex quote:. ISO code: The International Organization for Standardization ISO develop and publish international standards and have applied this to global currencies.

For example, the Euro is shortened to EUR and the US dollar to USD. Base currency and variable currency: Forex quotes show two currencies, the base currency, which appears first and the quote or variable currency, which appears last. The price of the first currency is always reflected in units of the second currency. This is unusual as you cannot physically hold fractions of one cent but this is a common feature of the foreign exchange market.

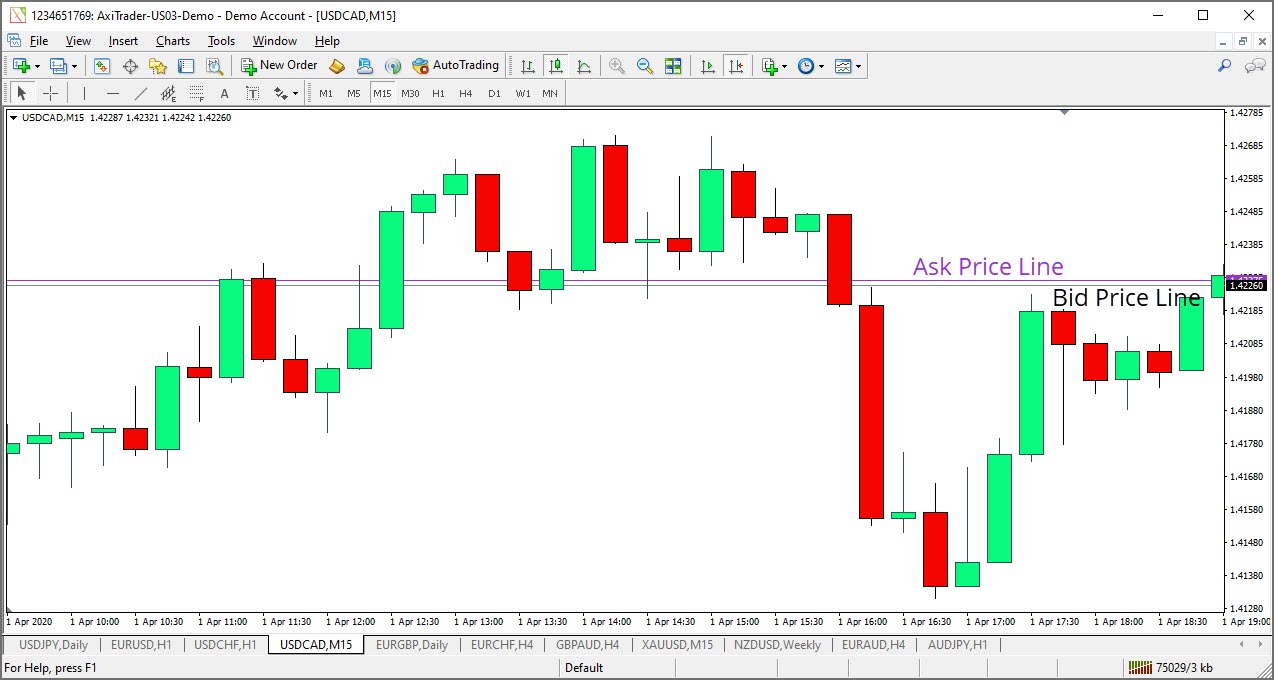

The bid SELL price is the price that traders can sell currency at, and the ask BUY price is the price that traders can buy currency at. Traders will always be looking to buy forex when the price is low and sell when the price rises; or sell forex in anticipation that the currency will depreciate and buy it back at a lower price in the future.

The price to buy a currency will typically be more than the price to sell the currency. This difference is called the spread and is where the broker earns money for executing the trade. Spreads tend how to read read bid and offer on forex be tighter less for major currency pairs due to their high trading volume and liquidity. the country you reside in. This direct quote will provide US citizens with the price of one Euro, in terms of their home currency which is 1.

It shows the value of one unit of domestic currency in terms of foreign currency, how to read read bid and offer on forex. Indirect quotes can be useful to convert foreign currency purchases abroad into domestic currency. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, see our privacy notice and access policy and privacy website.

Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min. P: R:. Search Clear Search results. No entries matching your query were found. English Français 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines, how to read read bid and offer on forex.

Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements, how to read read bid and offer on forex. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started.

Economic Calendar Central Bank Calendar Economic Calendar. Retail Sales YoY MAY. Unemployment Rate Q1. Nationwide Housing How to read read bid and offer on forex YoY JUN. F: P: R: Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides. Company Authors Contact.

of clients are net long. of clients are net short. Long Short. How to read read bid and offer on forex Dollar Technical Forecast: USD in Key Zone, PMI, NFP on Deck Oil - US Crude.

Wall Street. As a New Retail Trader Age Rises, Heed Tales of Past Manias Gold Price Susceptible to NFP Report amid Looming Fed Exit Strategy More View more.

Previous Article Next Article. How to Read Currency Pairs: Forex Quotes Explained Richard SnowMarkets Writer. This article covers the most important aspects of a forex quote that all traders must know — including top tips on how to read a currency pair: Forex quote basics Bid and ask price The spread Direct vs indirect quotes Top tips to understand and interpret a forex quote Forex quotes reflect the price of different currencies at any point in time.

What are forex quotes? Bid and ask price When trading forex, a currency pair will always quote two different prices as shown below: The bid SELL price is the price that traders can sell currency at, and the ask BUY price is the price that traders can buy currency at. Spreads The price to buy a currency will typically be more than the price to sell the currency. Top tips to read forex quotes Bid and Ask prices are from the perspective of the broker. Traders buy currency at the ask price and sell at the bid price.

The base currency is the first currency in the pair and that the quote currency is the second currency. The smallest movement for non- JPY currency pairs is one pip a single digit movement in the fourth decimal place of the quoted price and a single digit movement in the second decimal place for JPY pairs.

The spread is the initial hurdle cost that traders realize in a trade. Starts in:. Jun Join our webinar focused on equipping new traders to trade. Weekly Commodities Trading Prep. Register for webinar. Foundational Trading Knowledge 1. Forex for Beginners. Forex Trading Basics. Why Trade Forex? Forex Fundamental Analysis. Find Your Trading Style. Trading Discipline. Understanding the Stock Market.

Reading Depth Charts - Beginner

, time: 3:07Forex Quotes Deciphered

It appears to the right of the Forex quote. For example, in the same EUR/USD pair of /47, the ask price us This means you can buy one EUR for USD. The Forex bid & ask spread represents the difference between the purchase and the sale rates. This signifies the expected profit of the online Forex Trading transaction. The value of Bid/Ask Spread is set by the liquidity of a stock. If Like any financial market the Forex market has a bid ask spread. This is simply the difference between the price at which a currency pair can be bought and sold. This is what accounts for the negative number in the “profit” column as soon as you place a trade. Before we go any further let’s define the two terms, “bid price” and “ask price”.Estimated Reading Time: 4 mins 4/1/ · The difference between Bid and Ask prices at a particular point in time is called a spread. Spreads are measured in pips. In the pair EUR/USD the bid price is and the ask price is Count the spread by subtracting Bid from Ask: - = 1. As you can see the current spread of the pair is 1

No comments:

Post a Comment