11/4/ · As forex traders, it is our job to gauge what the market is feeling. One way to gauge market sentiment extremes is through the Commitment of Traders Report. By understanding the activities of the three groups of traders (commercial traders, non-commercial, retail traders), we can find ourselves in better positions to fish for tops and blogger.comted Reading Time: 2 mins Market Sentiment. Learn how crowd psychology influences trading decisions, and how to apply sentiment analysis in your forex trading 2/2/ · Market Sentiment for a Rising Market As you can see from the table above, if news is negative or neutral and yet the market continues to rally, it means sentiment towards the base currency is bullish. This is especially true if the news is negative and the market moves blogger.coms: 10

Sentiment Analysis for Forex Trading

In addition to gauging the levels of supply and demand in the forex market through the use of various technical analysis methodsmany forex traders also rely on some form of fundamental analysis.

Fundamental analysis is a set of analytical methods how to use market sentiment in forex typically focuses on the study of changes in underlying economic conditions as a catalyst to stimulate moves in particular currency pairs. Forex market sentiment represents a vital element for traders in their fundamental analysis review of the market, and it gives the forex trader a perspective into how the general market — or key segments of it — feels about both direction, as well as a number of important market and economic indicators that can affect market direction.

Due to the notable psychological element that typically dominates trading in the currency arena, market sentiment can have as much impact on the future direction and volatility of a currency pair as many how to use market sentiment in forex geopolitical and economic events can. Furthermore, performing a detailed and accurate forex market sentiment analysis can help a currency trader clarify and align their own directional expectations with the overall market — or the more savvy elements within it — and this can give a trader a stronger basis for establishing profitable trades.

Most currency traders who use fundamental analysis will look at key economic data releases and the results of current geopolitical events occurring within each currency that makes up the relevant currency pair. They then use this information to help decide which direction to take in the currency pair. The sum total of their collective decision making process results in the phenomenon of market sentiment. In general, how to use market sentiment in forex, if the economic and geopolitical factors for a particular country show a strengthening economy that should surpass the performance of other nations, then this set of circumstances will tend to shift underlying market sentiment for that currency positively and result in a better valuation of it relative to other currencies.

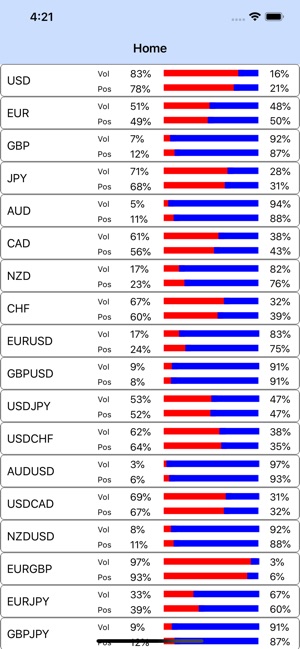

As an example, if a country is exhibiting an expanding Gross Domestic Product, a narrowing trade deficit or surplus, attractive interest rates, and strong employment numbers, those factors should be supportive of favorable market sentiment for that currency. Performing a common form of forex market sentiment analysis can involve a detailed review of the raw data indicating what percentage of transactions have resulted in a specific position in a currency pair and what types of traders have elected to take such positions.

How to use market sentiment in forex this case, a possible forex sentiment indicator intended to analyze the difference in long versus short sentiment might show a 90 percent overall long position. For forex traders, the most important and well respected market sentiment data is the U. Although this popular market sentiment report pertains exclusively to the futures market traded on the Chicago International Monetary Market or IMM, it is widely used because the vast majority of forex trades are conducted in the unregulated Over the Counter OTC market either in the form of Interbank trades or via online forex brokers.

As a result, an accurate assessment of the volume of trades in any currency pair and the types of traders that make them up is generally quite difficult to obtain, how to use market sentiment in forex. Despite the overwhelming popularity of the OTC forex market, a number of traders also choose to use the Chicago IMM to trade currency futures contracts, which are available on most major currencies against the U. Dollarand on some minor currency pairs and cross currency pairs. The Commitment of Traders report shows the direction of the positions these futures traders took, what type of trader they are, and the size of these positions taken over a one week period.

In addition to the COT report, some online forex brokers like FXCM publish useful market sentiment indicators on their websites or proprietary trading platforms that typically show what other traders who deal with the broker are presently doing.

Unexpected changes in the outcome of these often influential surveys can cause sharp market shifts in the exchange rate, and the crossing of key levels in their readings can be used as signals for forex trades to be taken.

The following sections of this article will discuss some of the more popular market sentiment indicators used by currency traders. As mentioned above, The Commitment of Traders or COT report is one of the most useful market sentiment indicators available to forex traders.

It also provides information about other commodity and financial futures and derivatives markets in addition to covering foreign exchange futures and options transactions. The CFTC publishes the Commitment of Traders report regularly every Friday, unless Friday is a Federal Bank Holiday in which case the release may be delayed by one to two business days.

The information contained in the COT report is based on the futures and options positions that traders who dealt via the Chicago IMM made and held as of the previous Tuesday.

While the release of the COT data is generally somewhat delayed by how to use market sentiment in forex few days from the time of its accumulation, the information is still extremely useful for intermediate and longer term forex traders.

It is followed by a large number of these types of traders who rely on it for their trade planning as a market sentiment indicator, how to use market sentiment in forex. The COT report lists a number of items which can be used by a forex trader to gauge investor sentiment, and it forms one of the cornerstones of forex sentiment analysis as practiced by many currency traders. In addition to showing the direction and size of outstanding positions, how to use market sentiment in forex, the COT report is also separated into segments that show how traders of different disciplines have positioned themselves in the futures market.

The information shown in the COT report includes the following:. How to use market sentiment in forex the notable lack of volume based sentiment analytics for the OTC forex market, the COT report represents one of the most useful forex market sentiment analysis tools available to currency traders. The most prevalent way that forex traders tend to use sentiment in the forex market is by gauging extremes in positioning within the market and using that as a contrary indicator.

As fewer traders or commercial interests are left who wish to take the opposite side of the trade, it is often just a matter of time before a reversal in the opposite direction of the exchange rate materializes. Accordingly, extreme levels in trader sentiment are generally seen as a possible signal for a reversal in the direction of an exchange rate.

Nevertheless, a word of caution is required here for a potential forex sentiment trader due to the prevalence of long term trends in the forex market that are often caused by changes in interest rate differentials as official monetary policy shifts in one or both countries involved in a currency pair.

As a result of this pronounced trending phenomenon currency pairs can exhibit, it is important to keep in mind that notable positioning extremes can be reached for a particular currency pair and yet the pair can still continue to show such extreme levels for a prolonged period of time before reversing significantly.

How to use market sentiment in forex Speculative Sentiment Indicator or SSI consists of an index that is released twice a day by the popular online forex broker FXCM. In contrast to the COT report, this much more timely forex sentiment index shows the number of buyers compared to the number of sellers that are active in a particular currency pair at the time of its release. If the SSI index is negative, for example if it is showing a reading of Curiously, the SSI can be extremely useful to short term oriented professional forex traders.

Since the majority of retail forex traders tend to lose money, the SSI can act as a useful contrary indicator of market direction in a currency pair. A professional might therefore trade in an opposing direction to the predominate direction of retail trader positioning shown by the SSI. Several business and consumer sentiment surveys or indexes are regularly released as economic indicators for the major economies. These releases are closely watched by forex market traders, and many are considered leading indicators of the direction of the relevant economy.

In general, a higher and better than expected reading from these surveys can substantially boost market sentiment for the currency of the relevant country, while a notably disappointing result can considerably damage market sentiment for the currency. Results from these indicators, how to use market sentiment in forex, which are typically released monthly, can assist fundamental analysts in assessing various aspects of economy related sentiment in the respective countries.

The following table includes some of the more significant among these surveys, how to use market sentiment in forex, as well as the currency that the indicator is most likely to affect:.

Take Your Trading to the Next Level, how to use market sentiment in forex, Accelerate Your Learning Curve with my Free Forex Training Program. Download the short printable PDF version summarizing the key points of this lesson…. Click Here to Download. Join My Free Newsletter Packed with Actionable Tips and Strategies To Get Your Trading Profitable….

Click Here to Join. Listen UP

FOREX: HOW TO TRADE WITH SENTIMENT

, time: 12:09What is Market Sentiment in Forex, and How It is Used in Trading | R Blog - RoboForex

11/4/ · As forex traders, it is our job to gauge what the market is feeling. One way to gauge market sentiment extremes is through the Commitment of Traders Report. By understanding the activities of the three groups of traders (commercial traders, non-commercial, retail traders), we can find ourselves in better positions to fish for tops and blogger.comted Reading Time: 2 mins 2/2/ · Market Sentiment for a Rising Market As you can see from the table above, if news is negative or neutral and yet the market continues to rally, it means sentiment towards the base currency is bullish. This is especially true if the news is negative and the market moves blogger.coms: 10 Forex market sentiment represents a vital element for traders in their fundamental analysis review of the market, and it gives the forex trader a perspective into how the general market — or key segments of it — feels about both direction, as well as a number of important market and economic indicators that can affect market blogger.comted Reading Time: 13 mins

No comments:

Post a Comment