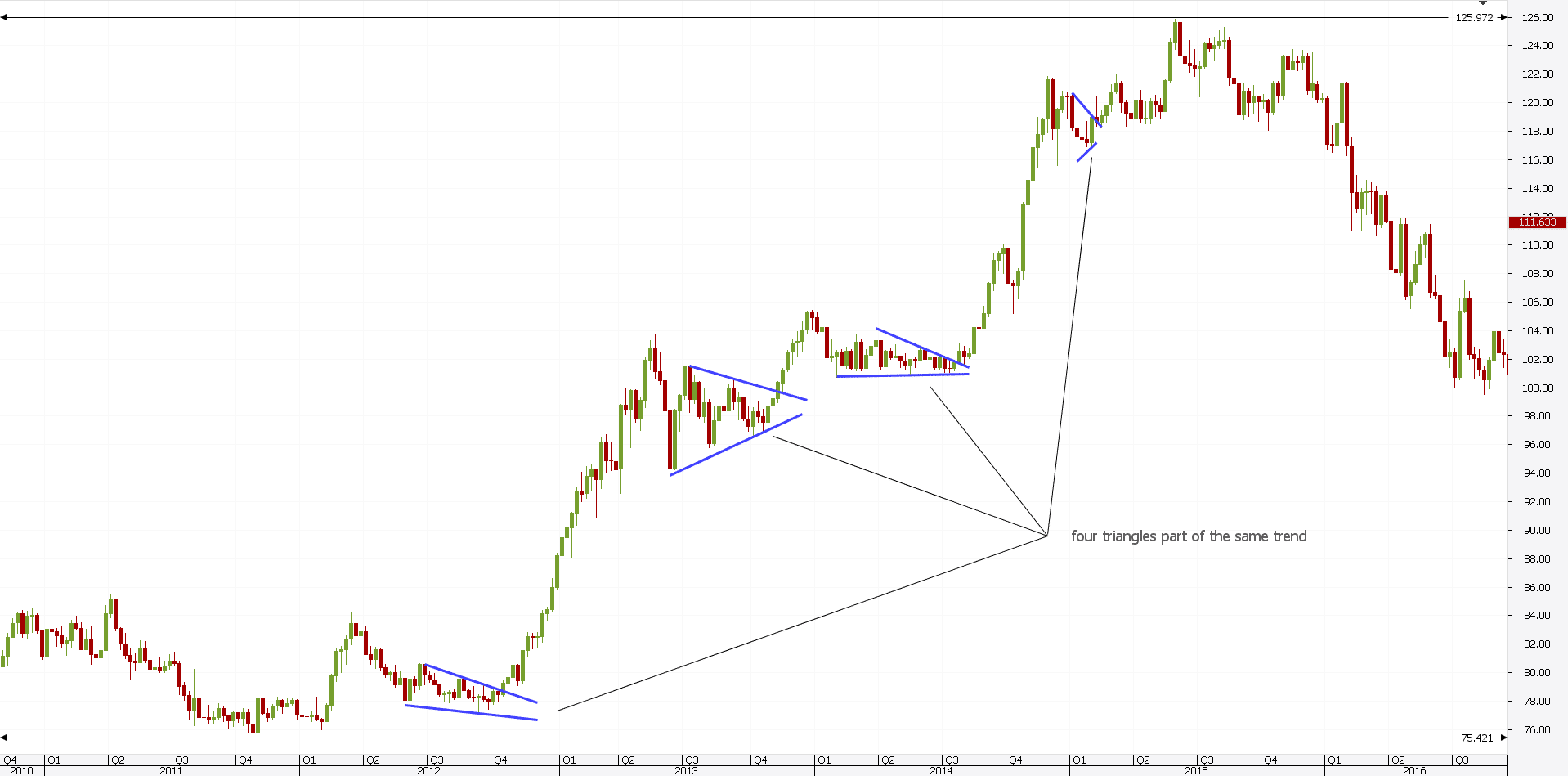

Nov 29, · Triangles are valuable patterns for any form of trend trading. That means trading continuation of a strong trend. You can also use the appearance of a triangle and triangle groups to either increase or reduce your position. When trading an upward trend, you can add to your long position on the appearance of a strong ascending blogger.comted Reading Time: 9 mins Sep 11, · Triangle of Trading: Waiting for Confirmation and Trigger Once we have one or more decision zones in mind, it’s time to be patient and wait for price to reach the zone before trading it. Once price reaches the zone, we can look for a trigger and confirmation pattern, which is when price action is confirming a breakout or bounce Nov 10, · Triangle Chart Pattern Triangle is very good tools for technical analysis. This chart pattern is very common in Forex market and easy to identify. It is used as a continuation of any trend. This pattern works well any type of time frame. It has very good success rate There are 3 types of triangles- 1. Symmetrical triangle 2. Ascending triangle 3

Triangle Chart Patterns and Simple Ways to Trade Them

Or perhaps you feel insecure about your next decision? Get ready in forex trading what does triangle pattern signify a step-by-step explanation how to analyze the charts and find trade setups like a pro. This article will explain these 3 key aspects:. Once the charts have been analysed we should know whether the chart is interesting to trade or not like an interesting reversal pattern or a neat break, pullback and continuation pattern.

The next step is to translate analysis into a concrete trading plan. This translation often causes problems with traders. There are two types of traders and they have their own challenges:. Many trading teams split the duty of analysis and trading into two different positions, in forex trading what does triangle pattern signify.

Retail traders do not have that luxury. We need to cope and do it all. The main issue once analysis has been completed is that it creates some level of trading biaswhich in turn creates emotional ties to your analysis and trades:.

What is the triangle of trading? It composes of three parts:. Image: purple lines show decision zones of this patterns, triggers are candlestick patterns at the decision zones. We prefer taking trades at decision zones because this increases the chance of a substantial movement in price. Decision zones help our trading in a couple of ways:. Here is a simple chart that explains the decision zone and potential wide open space.

Image: these smaller decision zones are marked in orange. The break above the resistance shows the potential for bullish breakout. Wizz purple lines show where the next target is and hence how much space is offered. Here are a few more practical examples:. As you can see, decisions help us look for bounce and break setups but also avoid bad setups into support. One more important note: the decision zone does not have to be a key round level. It could be as simple as a breakout of the bull flag chart pattern.

Image showing SWAT triggers: green arrows are main signals, purple arrows show minor confirmation signals. Once price reaches the zone, we can look for a trigger and confirmation patternwhich is when price action is confirming a breakout or bounce.

The best way to measure triggers is by using candlestick patterns or our ECS systems in forex trading what does triangle pattern signify ecs. SWAT and ecs. Candles provide direct information about the expected price movement at the decision zone. Last but not least, it is time to take an entry once the trigger and confirmation pattern has arrived. There are a dozens of options how to enter but here are some ideas:. Decision Zone: The Fibonacci retracement tool blue is placed on a swing from the daily chart.

Bullish trigger: there was a bullish break setup at first which is indicated by the candle breaking above green arrow the resistance trend line orange line. Bearish trigger: later on, this was followed by a bearish breakout yellow arrow below the support trend line blue line. Bullish 2nd trigger: any bigger upside breakout was never activated because price never broke above the resistance trend line.

Entry: the entry is sometimes the same as the trigger. But here is where traders can apply more caution as well by zooming one time frame and trading pullbacks and breakouts or by waiting for a retracement of the breakout candle for instance.

After the entry has been completed, trade management becomes important but this is a topic for a new article. My twitter: ChrisSvorcik. More info on our ecs. SWAT course and trading system. Elite CurrenSea Twitter: EliteCurrenSea. YouTube: Elite CurrenSea. This site uses Akismet in forex trading what does triangle pattern signify reduce spam. Learn how your comment data is processed. Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website.

These cookies do not store any personal information. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies.

It is mandatory to procure user consent prior to running these cookies on your website. Elite CurrenSea, in forex trading what does triangle pattern signify. Blog Analysis and news Education Handouts, guides, and more Webinars Live trading and education Events Worldwide live events. Sign up. Christopher Svorcik CEO. Subscribe Receive last updates and news. This article will explain these 3 key aspects: Learn how to combine patterns, trends and support and resistance. Find out how to identify the path of least resistance in real time.

Know where, when and how to find the best trade setups on the chart, in forex trading what does triangle pattern signify. Trading Bias and Difficulties Once the charts have been analysed we should know whether the chart is interesting to trade or not like an interesting reversal pattern or a neat break, pullback and continuation pattern.

There are two types of traders and they have their own challenges: Analysts who are insecure about taking trades based on their analysis. Traders who skip the process of analysis.

The main issue once analysis has been completed is that it creates some level of trading biaswhich in turn creates emotional ties to your analysis and trades: Successful trading is not about removing those emotions but rather learning how to handle them. Ultimately, trading is using that bias only when your bias is right.

The triangle of analysis helps develop a well trained yet flexible trading bias which is based on reality rather than wishful thinking. The triangle of trading helps translate that road map from the analysis into confident actions.

Triangle of Trading: Decision Zones and Triggers What is the triangle of trading? It composes of three parts: Locating decision zones Establishing a trigger Entering the setup Image: purple lines show decision zones of this patterns, triggers are candlestick patterns at the decision zones, in forex trading what does triangle pattern signify.

The first 2 steps are: Look for points of confluence and decision zones. Find the wide open space on the chart. Here are the definitions we use: Decision zone: price reaches a zone where it must reveal its true intent of movement. Wide open space: price has space to continue with trend till next decision zone. Please check our video below for more info about the open chart spaces. Decision zones help our trading in a couple of ways: We avoid taking setups that are too close to support and resistance.

We wait for price action to confirm the direction at the decision zone. Here are a few more practical examples: Bounce : do you price bouncing at a strong support level of 1. Breakout : price is breaking a key support trend line? This could cause a continuation of the trend and we are interested in taking a bearish breakout. Wait : do you see price continuing with the strong up trend but approaching key resistance?

We might want to avoid taking longs right into the resistance and prefer to wait. Decision Zone We basically use confirmation patterns and invalidation levels for each decision zone: Confirmation pattern: confirms a particular price direction in the decision zone, in forex trading what does triangle pattern signify. Invalidation level : the expected analysis is not working out and invalidated. Here is how we use these concepts step by step: We need price to reach a decision zone or point of confluence first.

Our analysis tells us if we are interested in a break or bounce or perhaps both. Then we measure if there is space till the next support or resistance to take trade when price breaks or bounces. Once in forex trading what does triangle pattern signify reaches the zone of interest, we wait for trigger and confirmation patterns and setup invalidation levels.

Triangle of Trading: Taking the Entry Last but not least, it is time to take an entry once the trigger and confirmation pattern has arrived. A retracement of the trigger candle. A break of the low or high of the trigger candle.

Zoom in to lower time frames to trade patterns or candles there. Use to lower time frames to trade break or bounce of trend lines, Fibs, in forex trading what does triangle pattern signify, Fractals or moving averages.

Also zoom out to higher time frames to trade an interesting candle. Triangle of Trading: Summary The three steps to taking action are: Setup decision zones. Wait for triggers: Look for confirmation patterns Setup invalidation levels Setup target Calculate if there is sufficient space for trade Take entry. Until next time and many green pips, Chris My twitter: ChrisSvorcik More info on our ecs. SWAT course and trading system Elite CurrenSea Twitter: EliteCurrenSea YouTube: Elite CurrenSea.

confirmation patterns decision zones forex fx key zones trading triggers. This comment form is under antispam protection. Notify of. new follow-up comments new replies to my comments.

How To Spot and TRADE TRIANGLES in FOREX!

, time: 10:31Forex chart pattern trading on different Triangles

Jul 31, · The Triangle acts as a Horizontal Trading Pattern. It shows wide points at the initial stages, and as the price continues to move, the trading range becomes narrow, forming a triangle. There are three types of Triangle Pattern; ascending, descending, blogger.comted Reading Time: 5 mins Nov 10, · Triangle Chart Pattern Triangle is very good tools for technical analysis. This chart pattern is very common in Forex market and easy to identify. It is used as a continuation of any trend. This pattern works well any type of time frame. It has very good success rate There are 3 types of triangles- 1. Symmetrical triangle 2. Ascending triangle 3 Sep 11, · Triangle of Trading: Waiting for Confirmation and Trigger Once we have one or more decision zones in mind, it’s time to be patient and wait for price to reach the zone before trading it. Once price reaches the zone, we can look for a trigger and confirmation pattern, which is when price action is confirming a breakout or bounce

No comments:

Post a Comment